Diminishing value method of depreciation formula MhariaElliana

The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16. This kind of depreciation method is said to be highly charged in the first period, and then subsequently reduce.

Diminishing Balance Method Depreciation part 5 YouTube

Diminishing Balance Depreciation . Diminishing, reducing, or "double-declining" depreciation is used for assets that have a faster expected rate of depreciation. The double-declining-balance method more accurately represents how quickly vehicles depreciate and can therefore be used to more closely match cost with the benefit from using the.

What is Diminishing Balance Depreciation? Definition, Formula & Accounting Entries ExcelDataPro

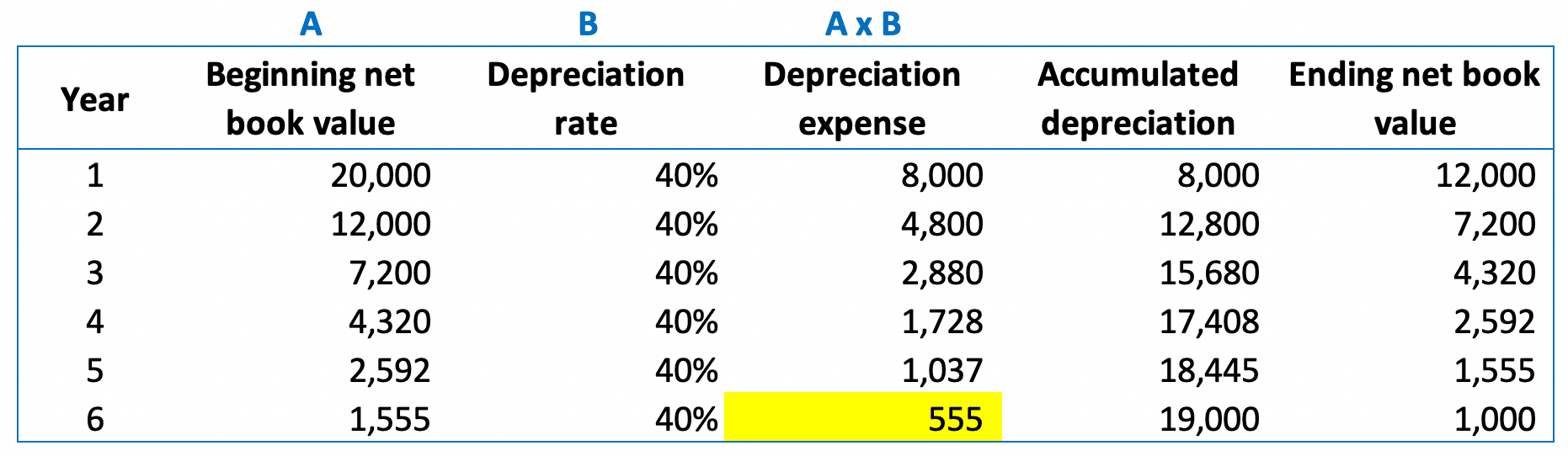

The declining balance method is a type of accelerated depreciation used to write off depreciation costs earlier in an asset's life and to minimize tax exposure. With this method, fixed assets.

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

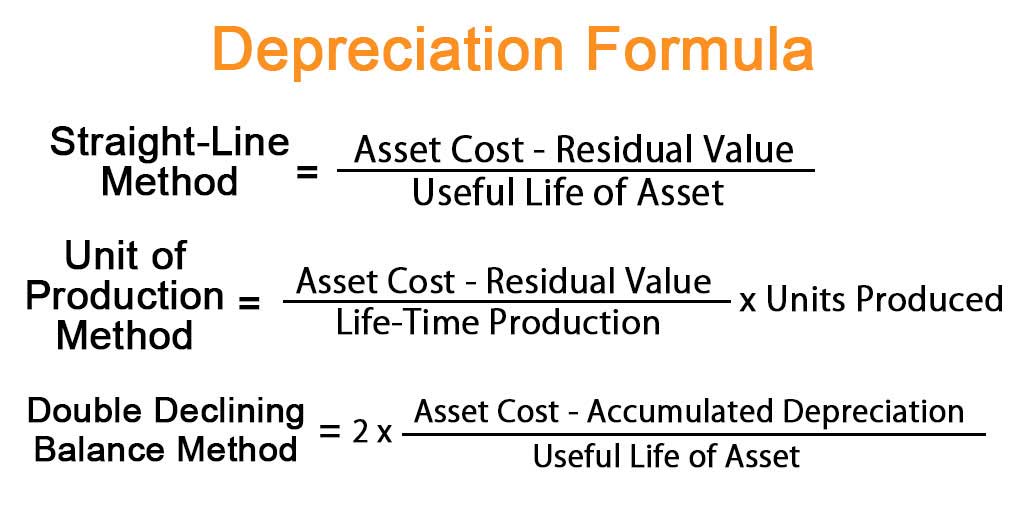

Available methods include the straight-line method, the diminishing balance method, and the units of production method. The depreciation charge for each period should be recognised in profit or loss, unless it's factored into the carrying amount of another asset. Let's explore this in more depth. Depreciation vs amortisation

Diminishing Balance Depreciation Method Written Down Value WDV Depreciation Method YouTube

The diminishing balance method, also known as the reducing balance method, is a method of calculating depreciation at a certain percentage each year on the balance of the asset which is brought from the previous year.

:max_bytes(150000):strip_icc()/double-declining-balance-depreciation-method-4197537-57ec7242afce4164a7e78fbea8a1d828.jpg)

DoubleDeclining Balance (DDB) Depreciation Method Definition With Formula

Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. As it uses the reducing book value it is also known as reducing balance method. In this method, the depreciation amount decreases each year.

Double declining method formula OrrynLuse

Declining balance is a method of computing depreciation rate for the value of an asset. The declining balance method is also known as reducing balance method or diminishing balance method. It is an accelerated depreciation method that results in larger depreciation amounts during the earlier years of an assets useful life and gradually lower.

Reducing or Diminishing Balance Method of Depreciation, Accounting Lecture Sabaq.pk YouTube

In this lesson, we explain what the straight line and diminishing balance depreciation methods are, show the formula for calculating the depreciation methods.

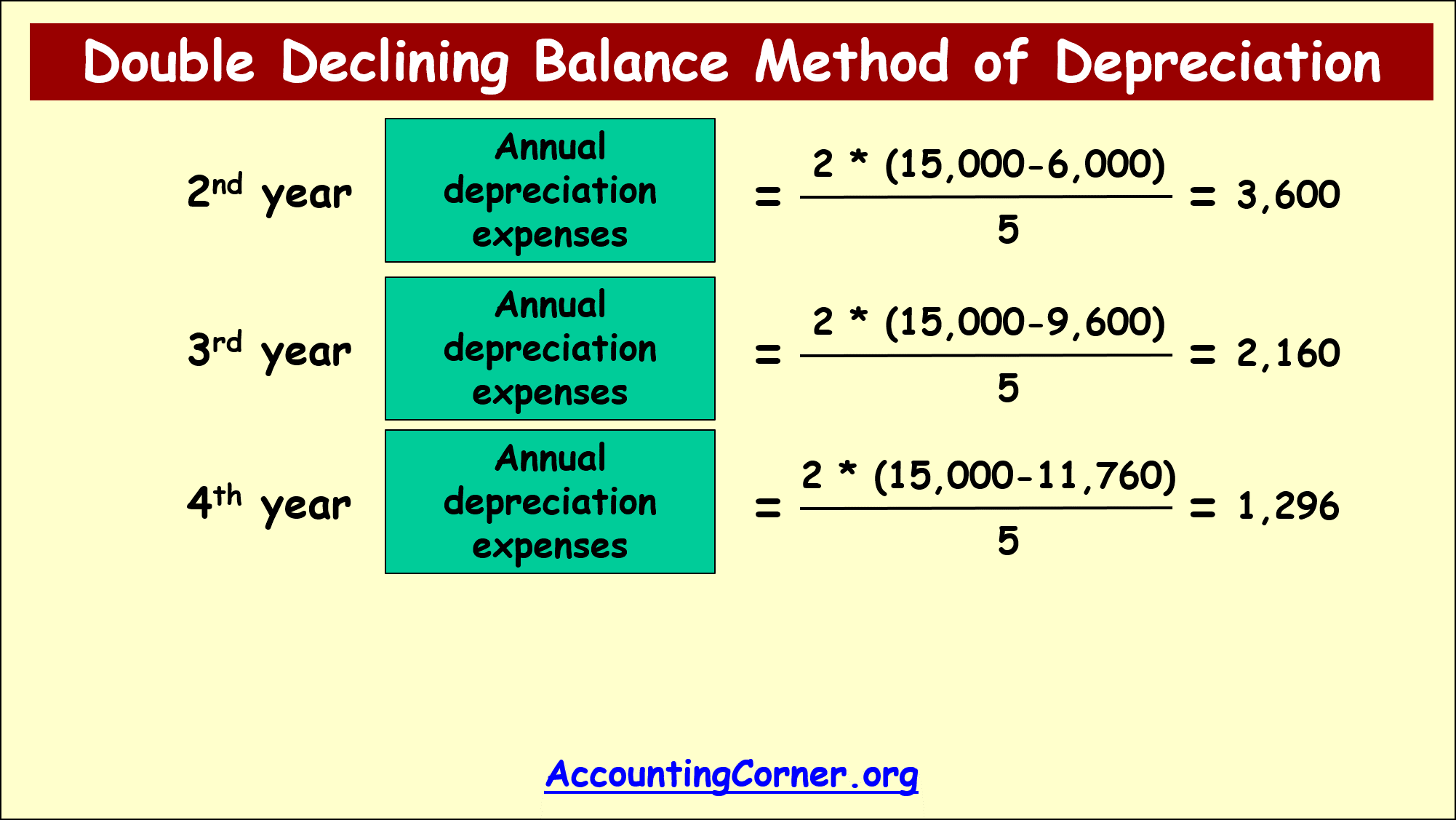

Double Declining Balance Method of Depreciation Accounting Corner

This method is a mix of straight line and diminishing balance method. Thus, depreciation is charged on the reduced value of the fixed asset in the beginning of the year under this method. This is just like the diminishing balance method. However, a fixed rate of depreciation is applied just as in case of straight line method.

Diminishing Balance Method Or Reducing Balance Method Or Written Down Value Method Important 2021

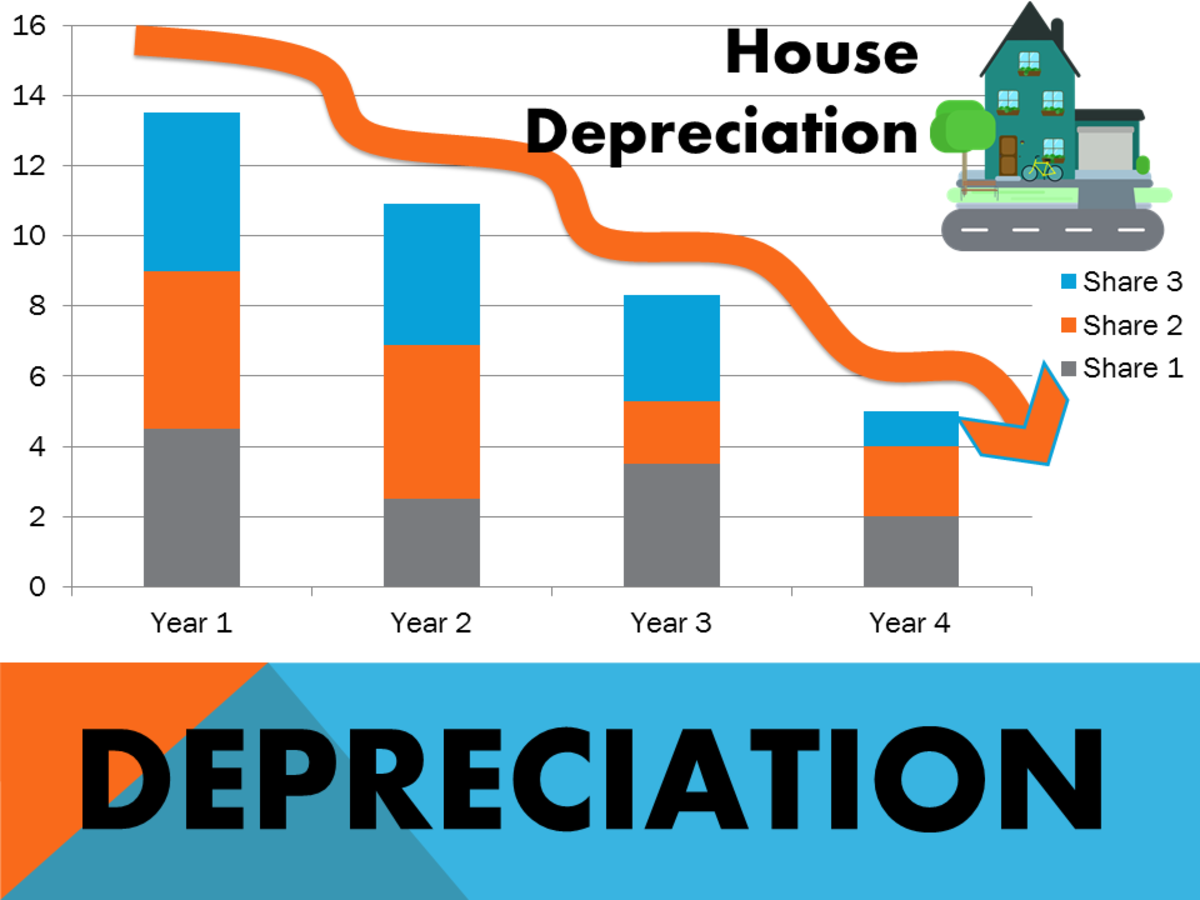

Diminishing balance method - a type of decreasing charge or accelerated method which creates higher depreciation expense in the earlier years and lower depreciation expense in later periods. Activity method - is a variable-charge approach where depreciation expense will depend on the activity related to the asset.

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

1. Straight-line depreciation The straight-line method calculates an average decline in value over a period. This is the most common method and the simplest way to calculate depreciation. In straight-line depreciation, the expense amount is the same every year over the useful life of the asset.

Depreciation Diminishing Balance Method Purchase and Sales of Assets

The double-declining balance depreciation method is an accelerated depreciation method that counts as an expense more rapidly (when compared to straight-line depreciation that uses the same.

:max_bytes(150000):strip_icc()/DecliningBalanceMethod-9dd78f1fccd846d69ccea14c595645df.jpg)

Declining Balance Method What It Is, Depreciation Formula

What is the Double Declining Balance Depreciation Method? The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. It is frequently used to depreciate fixed assets more heavily in the early years, which allows the company to defer income taxes to later years.

Diminishing Balance Method of Depreciation Example

Declining Balance Depreciation Asset Cost: $ Salvage Value: $ Useful Life (years): Depreciation Factor: Placed in service: Fiscal Year: your tax year Round to Dollars: Calculator Use Use this calculator to calculate and print an accelerated depreciation schedule of an asset for a specified period.

Declining Balance Depreciation Calculation Example Accountinguide

This results in higher depreciation expenses in the initial years, in line with the higher productivity showcased by the asset. As the useful life of the assets falls, the amount of depreciation also reduces. The reducing balance method is alternatively called the declining balance method or the diminishing balance method.

Double Declining Balance Method of Depreciation Accounting Corner

Diminishing Balance Method According to the Diminishing Balance Method, depreciation is charged at a fixed percentage on the book value of the asset. As the book value reduces every year, it is also known as the Reducing Balance Method or Written-down Value Method.